Faculty of Commerce: Tatsuro KAKESHITA

Tatsuro KAKESHITA Ph.D.

to be continued

to be continued

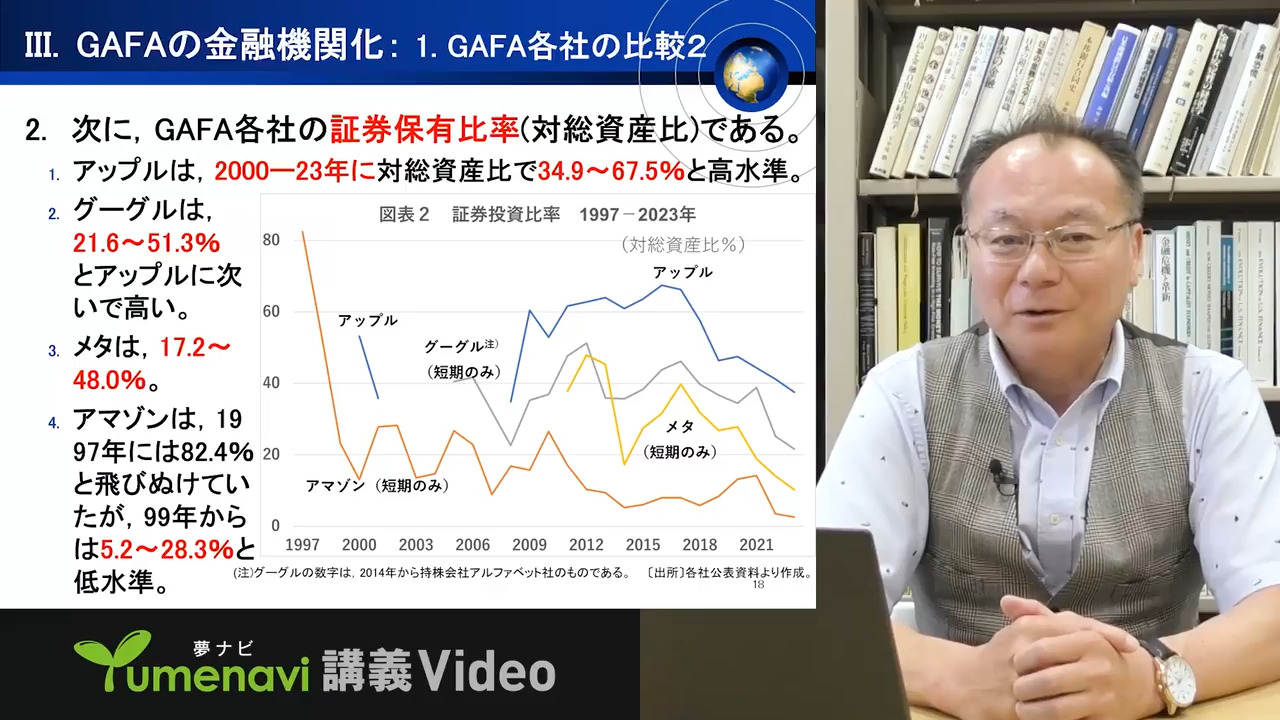

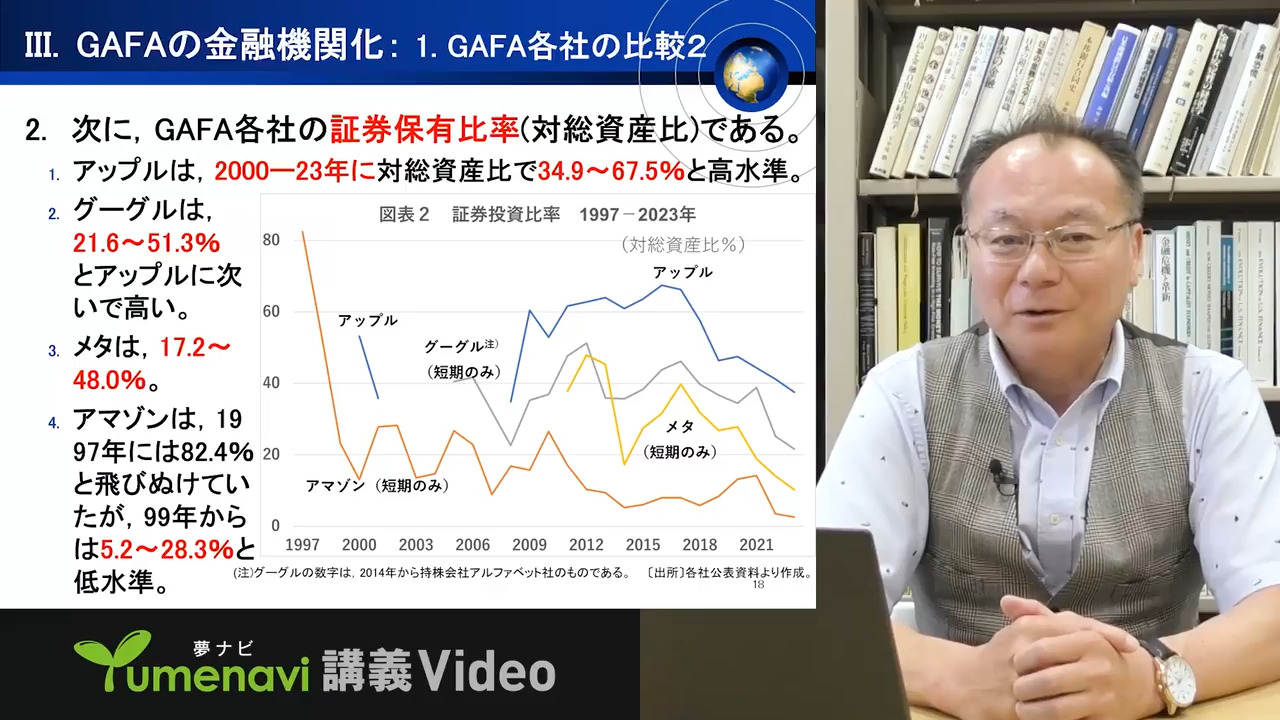

- YUMENAVI Lenture Video "GAFA's banking and financial businesses" was published on July 24,2024.

- Weekly Toyo Keizai featured my paper "GAFA's banking and financial businesses"

as a Think tank selection report on November 6, 2021.

as a Think tank selection report on November 6, 2021.

- We got 2021's Nomura School of Advanced Management Grant (Co-Investigator, Tatsuro KAKESHITA)

, Research Project "The study of banking and financial businesses of big tech in China, U.S. and India."

, Research Project "The study of banking and financial businesses of big tech in China, U.S. and India."

- I was invited to the meeting of firewall regulations between banks and securities companies at Japan Securities Dealers Association on March 10, 2021.

- We went to London for the interview concerning the Ring-fencing supported by JSPS KAKENHI Grant Number JP16K03920 on September 4 through 8, 2018. The visiting places were as follows.

- We went to New York and Washington, D.C. for the interview concerning the influence of monetary policies to the changing business of U.S. major financial institutions supported by JSPS KAKENHI Grant Number JP16K03920 on March 20 through 24, 2017. The visiting places were as follows.

- I got 2016-18's JSPS KAKENHI Grant Number JP16K03920 (Principal Investigator, Tatsuro KAKESHITA)

, Research Project "The Underwriting Business of Major U.S. Financial Holding Companies in the Capital Market Oriented System" and 2016's Grant-in-Aid for Publication of Scientific Research Result, Scientific Literature JP16HP5156 "The Formation Process of U.S. OTD Model."

, Research Project "The Underwriting Business of Major U.S. Financial Holding Companies in the Capital Market Oriented System" and 2016's Grant-in-Aid for Publication of Scientific Research Result, Scientific Literature JP16HP5156 "The Formation Process of U.S. OTD Model."

- 2015's Publication Grant of Japan Securities Scholarship Foundation

supported The Changing Business of U.S. Major Financial Holding Companies: The Formation Process of OTD Model, Tokyo: NIHON KEIZAI HYORONSHA, Ltd.

supported The Changing Business of U.S. Major Financial Holding Companies: The Formation Process of OTD Model, Tokyo: NIHON KEIZAI HYORONSHA, Ltd.

- 2024/Present: Director. Society for Japan Society of Monetary Economics, Tokyo, Japan.

- 2022/Present: Member. Capital Markets and Corporate Governances Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, Osaka, Japan.

- 2022/Present: Member. Japan and U.S. Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, Tokyo, Japan.

- 2021/Present: Representative Director. Society for the Economic Studies of Securities,

Tokyo, Japan.

Tokyo, Japan.

- 2019/Present: Professor. Faculty of Commerce, Fukuoka University, Fukuoka, Japan.

- 2017/2021: Executive Director for General Affairs. Society for the Economic Studies of Securities, Tokyo, Japan.

- 2017/Present: Director. Japan Society for the Study of Credit Theory, Tokyo, Japan.

- 2015/2017: Executive Director for Editing Annals. Society for the Economic Studies of Securities, Tokyo, Japan.

- 2014/2022: Director. Society for Japan Society of Monetary Economics, Tokyo, Japan.

- 2013/2015: Director. Society for the Economic Studies of Securities, Tokyo, Japan.

- 2011/Present: Visiting fellow. Public Interest Incorporated Foundation, Japan Securities Research Institute,

Tokyo, Japan.

Tokyo, Japan.

- 2010/2022: Member. Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, Tokyo, Japan.

- 2004/2019: Professor. Faculty of Economics, Matsuyama University, Ehime, Japan.

- 2000/2000: Visiting scholar. Department of

Economics, University of Massachusetts, Amherst,

Massachusetts, U.S.A.

Massachusetts, U.S.A.

- 1999/2000: Visiting scholar. Department of

Economics, University of Notre Dame, Indiana, U.S.A.

- 1995/2004: Assistant & Associate professor. Faculty of

Economics, Matsuyama University, Ehime, Japan.

- 1994/1995: Research assistant. Faculty of Economics, Kyushu University,

Fukuoka, Japan.

- "The Structural Analysis of the Managed Currency System: The Case

of the Postwar U.S. Banking System," Political Economy Workshop,

University of Massachusetts, Amherst,

September 13, 2000.

- "Amortized Loans by U.S. Banks," 2000

URPE Summer Conference, Camp Chinqueka, Connecticut, August 20, 2000.

- "U.S. Bank Loans in Credit Crunches: In Relation to the Postwar

Corporate Finance," Federal

Reserve Bank of St. Louis, September 16, 1997.

- Robert Pollin,

"Public Credit Allocation through the Federal Reserve: Why It Is

Needed; How It Should Be Done." in Gary A.Dymski,

Gerald Epstein and Robert Pollin, eds., Transforming the U.S.

Financial System: Equity and Efficiency for the 21st

Century, New York: M.E. Sharpe 1993. = Japanese, Tokyo: NIHON

KEIZAI HYORONSHA, Ltd, 2001.

"Public Credit Allocation through the Federal Reserve: Why It Is

Needed; How It Should Be Done." in Gary A.Dymski,

Gerald Epstein and Robert Pollin, eds., Transforming the U.S.

Financial System: Equity and Efficiency for the 21st

Century, New York: M.E. Sharpe 1993. = Japanese, Tokyo: NIHON

KEIZAI HYORONSHA, Ltd, 2001.

- Gary A. Dymski,

"The 'bubble economy' and banking structure: A

Minsky Perspective on recent California, Japanese, and Korean

experience," Ehime

University, Ehime, Japan, March 27 1998.

"The 'bubble economy' and banking structure: A

Minsky Perspective on recent California, Japanese, and Korean

experience," Ehime

University, Ehime, Japan, March 27 1998.

- The Changing Business of U.S. Major Financial Holding Companies: The Formation Process of OTD Model, Tokyo: NIHON KEIZAI HYORONSHA, Ltd, 2016. (2015's Publication Grant of Japan Securities Scholarship Foundation)

- The Structural Analysis of the Managed Currency System: The Case of the

United State, Matsuyama University Research Center Report No.39, 2002.

- "The Formation Processes of U.S. and Japanese-type Securitization Markets," in Tatsuro Kakeshita, Kei-ichiro Nishio and Kohei Hasui, Japanese and U.S. Securitizations and Management Strategies of Regional Banks: Toward Robust Monetary Policies, Chapter 1, Matsuyama University Area Research Center Series No.17, Matuyama University Research Institutes, 2021.

- "Securitization Business of Megabank Groups and their Profits," General Analysis of Mordern Financial and Capital Markets, Chapter 11, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2021.

- "The Changing Business of U.S. and U.K. Big Banking Groups and Financial Depth,"

Transforming Financial and Securities Business, Chapter 10, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2018.

Transforming Financial and Securities Business, Chapter 10, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2018.

- "Why are their Income Structures of U.S. and U.K. Big Banking Groups different?" in Tatsuro Kakeshita and Kei-ichiro Nishio, The U.S. and U.K. Big Banks and Japanese Regional Banks: Financial System, Changing Business and Globalization, Chapter 1, Matsuyama University Area Research Center Series No.15, Matuyama University Research Institutes, 2018.

- "Modern Financial Business," Yoichi Kawanami and Takao Kamikawa, Modern Banking and Finance, New Edition, Chapter 7, Tokyo: YUHIKAKU Publishing Co., 2016.

- "The Underwriting Business of Major U.S. Financial Holding Companies,"

Transformation in Capital Markets and Securities Business, Chapter 11, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2015.

Transformation in Capital Markets and Securities Business, Chapter 11, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2015.

- "Preface," "The Current State and Problems of Chinese Major Financial Institutions" and "Conclusion," in Yoshikazu Ujikane, Tatsuro Kakeshita, Yoshiei Seino and Kei-ichiro Nishio, The Current State and Problems of Chinese Financial Institutions: Toward Shadow Banking System, Chapter 2, Matsuyama University Area Research Center Series No.13, Matuyama University Research Institutes, 2015.

- "Underwrinting and Trading by U.S. Major Financial Institutions,"in Security Management Workshop, ed., The Trend of Financial Regulation and Securities Business, Chapter 7, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2011.

- "Major Financial Institutions before and after the Subprime Crisis: their Changing Business and Profitability,"

in Hiroshi Shibuya, ed., American-model Company and Finance: Globalization, IT and Wall Street, American Economy & Society Series No.10, Chapter 5, Kyoto: SHOWADO, 2011.

in Hiroshi Shibuya, ed., American-model Company and Finance: Globalization, IT and Wall Street, American Economy & Society Series No.10, Chapter 5, Kyoto: SHOWADO, 2011.

- "The Origin of U.S. Non-Recourse Finance: Bank Loan Sales in Historical Perspective," in Motoyasu Takahashi, Takayuki Matsui and Yoshito Yamaguchi, eds., Network of Trust and Confidence in Global Society: Organization and Community, International Comparative Research Series No.2, Chapter 7, Tokyo: AKASHI SHOTEN Co., Ltd, 2008.

- "The Green ship finance," JSRI Current Affairs Essay, 'The Buttonwood Agreement,' Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.64, No.1, January 2024.

- "The Green ship finance in Europe:Loans and guarantees for global shipbuilding,"

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.124, Special issue of US and Japan Capital Markets Workshop, December 2023.

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.124, Special issue of US and Japan Capital Markets Workshop, December 2023.

- "Financial DX and the future of retail financial businesses: Case of U.S. big Tech,"

Yu-Cho Foundation, Personal Finance, Spring 2022.

Yu-Cho Foundation, Personal Finance, Spring 2022.

- "Amazon's banking and Apple's financial businesses in financialization,"

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.115, September 2021.

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.115, September 2021.

- "The Formation of Japanese-type Securitization Market and its Features," Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.60, No.2, February 2020.

- "The Formation of American and Japanese-type Securitization Markets and their Characteristics," Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.108, December 2019.

- "Are their Income Structures of U.S. and U.K. Big Banking Groups different? Exploring the Inside of Financialization," Symposium: Financialization and its Problems after Global Financial Crisis, Japan Society for the Study of Credit Theory, The Study of Credit Theory, No. 36, May 2018.

- "Income Structures of U.K. Big Four Banking Groups," Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.57, No.5, May 2017.

- "The Formation of OTD Model by Major U.S. Financial Holding Companies," Annals of Society for the Economic Studies of Securities, No.51, December 2016.

- "The Development of U.S. Non-Recourse Finance: The Modern Basis of Securitization," Annals of Society for the Economic Studies of Securities, No.50, December 2015.

- "The Underwriting Business of Major U.S. Financial Holding Companies: The Historical Process,"

Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.54, No.10, October 2014.

Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.54, No.10, October 2014.

- "U.S. Major Financial Institutions in the Subprime Crisis: Did they Change their Income Structures?" Symposium: Subprime Crisis and Turmoil in Financial Markets: The Present-Day Form of Financial Crisis, Japan Society for the Study of Credit Theory, The Study of Credit Theory, No. 31, June 2013.

- "Did the Japanese and U.S.

Major Financial Institutions Change their Income Structures?" Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.52, No.2, February 2012.

- "U.S. Major Financial Institutions' Profitability before and after the Subprime Crisis," Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.70, June 2010.

- "The Changing Business of U.S. Money Center Banks: Loan Sales and Derivatives,"

Annals of

Society for the Economic Studies of Securities, No.43, July 2008.

Annals of

Society for the Economic Studies of Securities, No.43, July 2008.

- "Interest Rate Swaps by U.S. Money Center Banks: How Do They compare with Major Investment Banks?"Annals of Society for the Economic Studies of Securities, No.41, July 2006.

- "U.S. Commercial Banks and the Secondary Market in Public Debt: Exchangeability

for Money and Liquidity," Annals of Society for the Economic Studies of

Securities, No.39, May 2004.

- "Asset Backed Securities of U.S. Commercial Banks: A

Historical Perspective," Annals of Society for the Economic Studies of Securities,

No.37, May 2002.

- "Amortized Loans by U.S. Commercial Banks," Annals of Society for the Economic

Studies of Securities, No.35, May 2000.

- "The U.S. Monetary Policy and the National Debt," Annals of

Society for the Economic Studies of Securities, No.29, May 1994.

- "Shiftability and Money Markets," Kyushu Association of Economic Science, The

Annual Report of Economic Science, No.31, November 1993.

- "Origin and introduction of UK ring fenced banks: Old and new problems," Fukuoka University review of commercial sciences, Essays Commemorating the Retirement of Professor Ken Kawai, Vol.62, Nos.1, 2, March, 2019.

- "The Development of U.S. Non-Recourse Finance: The Modern Basis of Securitization," Rikkyo Economic Review, Essays Commemorating the Retirement of Professor Tooru Kitahara, Vol.69 No.3, January 2016.

- "A Perspective on What We Know about U.S. Money Center Banks," Meijo Review, Number Dedicated to Professor Kiyoshi OBA, Vol.13 No.4, March 2013.

- "The Installment Payment Method and Liquidity of U.S. Commercial Banks: Toward the Secondary Market in Loans,

Securitization and Interest Derivatives," Matsuyama University Review, 80th Anniversary Commemorative Edtion,

September 2004.

- "Amortized Loans by U.S. Commercial Banks (1), (2), (3)" Matsuyama University

Review, Vol.10 No.4, No.5 and No.6, October, December 1998 and February 1999.

- "Liquidity of the U.S. Term Loans after World War II," Matsuyama University

Review, Vol.8 No.5, December 1996.

- "The U.S. Bank Credit in the Corporate Finance from 1960s to 1980s," Matsuyama

University Review, Vol.7 No.6, February 1996.

- "Discount Policy and Open Market Operations in the United States: Before and After the

'Accord'," KYUSHU-DAIGAKU-DAIGAKUIN- KEIZAIGAKUKAI, THE KEIZAI RONKYU, No.88, March

1994.

- "The Federal Funds Market and Economization of Money,"

KYUSHU-DAIGAKU-DAIGAKUIN-KEIZAIGAKUKAI, THE KEIZAI RONKYU, No.84, October 1992.

- Akira Oh-hashi and Satoru Nakamoto, ed., The Political Economy of the Wall Street, Tokyo: Bunshindo, Japan Society of Monetary Economics, ed., Review of Monetary and Financial Studies, Vol.44, March 2022.

- Tokutaro Shibata, ed., Global Economic Crisis and Its Aftermath, Tokyo: NIHON KEIZAI HYORONSHA, Ltd, Japan Society of Political Economy, ed., Political Economy Quarterly, Vol.54, No.2, July 2017.

- Reply by Tokutaro Shibata, Japan Society of Political Economy, ed., Political Economy Quarterly, Vol.55, No.2, July 2018.

- Masayoshi Tatebe, The 21st Century Type Global Economic Crisis and Monetary Policy, Tokyo: Shin Nihon Shuppansha, Japan Society of Monetary Economics, ed., Review of Monetary and Financial Studies, Vol.37, March 2015.

- Takeshi Fujimaki and Jun-ichi Shukuwa, Weak-Yen vs. Strong Yen: Which Way Should be Chosen? Tokyo: Toyo Keizai Inc., SHUKAN KINYUZAISEIJIJO, No.3035, July 29 and August 5, 2013.

- "Role and Organization of the Primary Market," in Society for the Economic Studies of Securities and Public Interest Incorporated Foundation, Japan Securities Research Institute, eds., Encyclopedia of Securities, Part 1. Chapter 4. I., Tokyo: KINZAI Institue for Financial Affairs, Inc., 2017.

- Finance Theory in Hisao Kanamori, Kenjiro Ara and Chikashi Moriguchi, eds., YUHIKAKU Dictionary of Economic Terms, Tokyo: YUHIKAKU Publishing Co., 2013.

- "Federal Funds Market," in Ikuya Fukamachi, Shizuya Nishimura, Eisuke Ono and Satoru

Yoshida, eds., OTSUKI Dictionary of Money, Banking and Finance, Tokyo: OTSUKI SHOTEN Publishers, 2002.

- "The Present Condition and the Subject of China Major Financial Institutions," Institute of International Economy, UIBE-Faculty of Economics, Matsuyama University Joint Symposium, "The Future Cooperation between Japan and China on Economic and Financial Issues," at University of International Business and Economics in Beijing, China, March, 2013.

- "The bad loan problems of the NISHI-NIPPON Bank and the FUKUOKA City Bank: main bank loan concentration and and non-main banks loan collection," Capital markets and corporate governance Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, September 2025.

- "The bad loan problems of the NISHI-NIPPON Bank and the FUKUOKA City Bank: Weakening of main bank relationships and bank efficiency," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), March 2025.

- "The Green ship finance in Europe:Loans and guarantees for global shipbuilding," Monetary Conference of Kyushu University, March 2024.

- "The Green ship finance in Germany:Loans and guarantees for global shipbuilding,"

95th Society for the Economic Studies of Securities at Nihon University, September 2023.

95th Society for the Economic Studies of Securities at Nihon University, September 2023.

- "The Green ship finance in Europe:Loans and guarantees for global shipbuilding," US and Japan Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, September 2023.

- "GAFA's banking and financial businesses in financialization,"

Finance Plus Forum, 17th Workshop, March 2023.

Finance Plus Forum, 17th Workshop, March 2023.

- "Amazon's banking and Apple's financial businesses in financialization,"

US and Japan Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, December 2021.

US and Japan Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, December 2021.

- "Invasion to financial and securities business by Big Tech,"

Theme Session, "The Competition concerning FinTech and structural changes of the US financial industry," Panerist, 93th Society for the Economic Studies of Securities, September 2021.

Theme Session, "The Competition concerning FinTech and structural changes of the US financial industry," Panerist, 93th Society for the Economic Studies of Securities, September 2021.

- "Invasion to financial and securities business by Big Tech," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), August 2021.

- "Amazon's banking and Apple's financial businesses in financialization," Monetary Conference of Kyushu University, March 2021.

- "Securitization Business of Megabank Groups and their Profits," 92th Society for the Economic Studies of Securities, September 2020.

- "The Formation of American and Japanese-type Securitization Markets and their Characteristics," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), December 2019.

- "The Formation of American and Japanese-type Securitization Markets and their Characteristics,"

Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, November 2019.

Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, November 2019.

- "The Formation of the Capital Market Oriented Financial System," Theme Session, "US Changing Economic Structure and Financial and Capital Market Reaction," Panerist, 90th Society for the Economic Studies of Securities at Kanagawa University, May 2019.

- "Origin and introduction of UK ring fenced banks: Old and new problems," Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, January 2019.

- "Why are their Income Structures of U.S. and U.K. Big Banking Groups different?" European Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, November 2017.

- "Are their Income Structures of U.S. and U.K. Big Banking Groups different? Exploring the Inside of Financialization," Symposium: Financialization and its Problems after Global Financial Crisis, Japan Society for the Study of Credit Theory at Marine Palace Kagoshima, October, 2017.

- "The Formation of OTD Model by Major U.S. Financial Holding Companies," 85th Society for the Economic Studies of Securities at Meiji University, September 2016.

- "The Business Strategy of HSBC: Roberts R. and Kynaston D.[2015], The Lion Wakes: A Modern History of HSBC," Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, July 2016.

- "The Development of U.S. Non-Recourse Finance: The Modern Basis of Securitization," 84th Society for the Economic Studies of Securities at Yamaguchi University, November 2015.

- "The Underwriting Business of Major U.S. Financial Holding Companies," Japan Society of Monetary Economics at Tohoku University, October 2015.

- "The Underwriting Business of Major U.S. Financial Holding Companies," Monetary Conference of Kyushu University, August 2015.

- "The Development of U.S. Non-Recourse Finance: The Modern Basis of Securitization," Monetary Conference of Kyushu University, August 2015.

- "The Development of U.S. Non-Recourse Finance: The Modern Basis of Securitization," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), July 2015.

- "The Underwriting Business of Major U.S. Financial Holding Companies," Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, December 2014.

- "The Underwriting Business of Major U.S. Financial Holding Companies: The Historical Process," Securities Seminar, Public Interest Incorporated Foundation, Japan Securities Research Institute, September 2014.

- "The Originate to Distribute Model and its Formation Process by Major U.S. Financial Holding Companies," Monetary Conference of Kyushu University, March 2014.

- "The Originate to Distribute Model and its Formation Process by Major U.S. Financial Holding Companies," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), February 2014.

- "A Special Feature Analysis of U.S. Major Banks: The OTD Model of Big Three Commercial Banking Groups," Monetary Conference of Kyushu University, Auguat 2013.

- "A Perspective on What We Know about U.S. Money Center Banks," Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, May 2013.

- "A Perspective on What We Know about U.S. Money Center Banks," Monetary Conference of Kyushu University, March 2013.

- "U.S.

Major Financial Institutions in the Subprime Crisis: Did they Change their Income Structures?" Symposium: Subprime Crisis and Turmoil in Financial Markets: The Present-Day Form of Financial Crisis, Japan Society for the Study of Credit Theory at Fukuoka University, September 2012.

- "U.S.

Major Financial Institutions in the Subprime Crisis: Did they Change their Income Structures?" Monetary Conference of Ryukoku University, August 2012.

- "Did the U.S.

Major Financial Institutions Change their Income Structures? Exploring the Root Causes of their Competitiveness," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), July 2012.

- "Did the Japanese and U.S.

Major Financial Institutions Change their Income Structures?" Monetary Conference of Kyushu University, March 2012.

- "Did the Japanese and U.S.

Major Financial Institutions Change their Income Structures?" Securities Seminar, Public Interest Incorporated Foundation, Japan Securities Research Institute, January 2012. (Securities Review, Vol.52, No.2, February 2012)

- "U.S. Major Financial Institutions' Profitability before and after the Subprime Crisis," Japan Society of Monetary Economics at

Kobe University, September 2010.

- "U.S. Major Financial Institutions before and after the Subprime Crisis: their Changing Business and Profitability,"

Hiroshi Shibuya (Institute of Social Science, University of Tokyo), ed., American-model Enterprise and Finance Workshop, American Economy & Society Series No.10, July 2010.

Hiroshi Shibuya (Institute of Social Science, University of Tokyo), ed., American-model Enterprise and Finance Workshop, American Economy & Society Series No.10, July 2010.

- "U.S. Major Financial Institutions' Profitability before and after the Subprime Crisis," International Finance and Development Economics Workshop (Takahiro Sato, Kobe University), June 2010.

- "U.S. Major Financial Institutions' Profitability before and after the Subprime Crisis," Hiroshi Shibuya (Institute of Social Science, University of Tokyo), ed., American-model Enterprise and Finance Workshop, American Economy & Society Series No.10, May 2010.

- "Trading Revenue of U.S. Money Center Banks: In Relation to Investment Banking Business," Security Management Workshop,

Incorporated Foundation, Japan Securities Research Institute, February 2010.

- "The Changing Business of U.S. Commercial Banks: Loan Sales and Derivatives," Monetary Conference of Kyushu University, August 2009.

- "The Changing Business of U.S. Money Center Banks: Loan Sales and Derivatives," Japan Society of Monetary Economics at

Hiroshima University, October 2008.

- "Loan Sales and Derivatives Business of U.S. Money Center Banks: A Historical Perspective," Security Management Workshop,

Incorporated Foundation, Japan Securities Research Institute, September 2008.

- "Interest Rate Swaps by U.S. Money Center Banks: How Do They Compare with Major Investment Banks?" 64th Society for the Economic Studies of Securities at Osaka City University, October 2005.

- "Interest Rate Derivatives by U.S. Money Center Banks: A Historical Perspective," Japan Society of Monetary Economics at Nihon University, May 2005.

- "U.S. Retail Finance: Credit Cards and Asset Backed Securities,"

3rd

Comparative Financial System Research Workshop, U.S. Retail Finance Workshop, Financial Research and Training Center, Financial

Services Agency, Japanese Government, March 2004.

3rd

Comparative Financial System Research Workshop, U.S. Retail Finance Workshop, Financial Research and Training Center, Financial

Services Agency, Japanese Government, March 2004.

- "U.S. Commercial Banks and the

Secondary Market in Public Debt: Exchangeability for Money and Liquidity," 59th Society for the Economic Studies of Securities at

Kanagawa University, June 2003.

- "The Introduction of the Installment Payment by U.S. Commercial Banks:

Exchangeability for Money and Liquidity," Japan Society of Monetary Economics at Hitotsubashi

University, May 2003.

- "Asset Backed Securities of U.S. Commercial Banks: A Historical Perspective," 56th Society for the Economic Studies of Securities at Kyushu University, December 2001.

- "Credit Card Loans by U.S. Commercial Banks," Japan Society of

Monetary Economics at Fukushima

University, September 2001.

- "Amortized Loans by U.S. Commercial Banks and Money Markets," Japan

Society of Monetary Economics at Osaka City University, October 1998.

- "The U.S. Bank Credit in the Credit Crunches: In Relation to the Corporate

Finance after World War II," 44th Japan Society of Political Economy at

Matsuyama University, October 1996.

- "Discount Policy and Open Market Operations in the United States: Before

and After the 'Accord'," Japan Society of Monetary Economics at Nagasaki

University, November 1993.

- "Why do GAFAs enter banking and financial businesses?" Group session B, "What is the 'attractiveness' of research? (Courtesy of Ezaki Glico Co., Ltd.), 3min presentation 1, Poster presentation, Public Interest Incorporated Foundation, International Institute for Advanced Studies, Nationwide 3 Questions, Kyushu/Okinawa Region Edition (Kumamoto University), June 2025.

- "The Green Ship Finance in Europe:Loans and Guarantees for Global Shipbuilding,"

Society for the Economic Studies of Securities at Fukuoka University,

March 2023.

Society for the Economic Studies of Securities at Fukuoka University,

March 2023.

- "The Formation of American and Japanese-type Securitization Markets and their Characteristics," Japan Society for the

Study of Credit Theory at Kyushu University, December 2019.

- "The Originate to Distribute Model and its Formation Process

by Major U.S. Financial Holding Companies," Japan Society for the

Study of Credit Theory at Kyushu University, March 2015.

- "U.S. Major Financial Institutions before and after the Subprime Crisis: their Changing Business and Profitability," Japan Society for the

Study of Credit Theory at Kyushu University, March 2011.

- "The Changing Business of U.S. Money Center Banks: Loan Sales, Securitization and Derivatives," Japan Society of Monetary Economics at Kyushu University, March 2006.

- "Interest Rate Derivatives by U.S. Money Center Banks: Investment Banking Business by Commercial Banks," Japan Society of Monetary Economics at

International University of Kagoshima, March 2005.

- "The Installment Payment and Liquidity of U.S. Commercial Banks: The Cases of

Term Loans, Mortgage Loans and Consumer Loans," Japan Society of Monetary

Economics at Kyushu University, March 2003.

- "Installment Credit in U.S. Consumption Society: Home Equity loans and Credit Card

Loans," Japan Society for the

Study of Credit Theory at Kyushu University, March 2001.

- "Amortized Loans by U.S. Commercial Banks," Society

for the Economic Studies of Securities at Osaka Securities Hall, March 1999.

- "Liquidity of U.S. Mortgage Loans: Amortized Loans by Commercial Banks," Japan Society of Monetary Economics at Kyushu University, March 1998.

- "The U.S. Monetary Policy and the National Debt,"

Society for the Economic Studies of Securities at Seinan Gakuin University,

September 1993.

- "Shiftability and Money Markets," Kyushu Association of Economic Science

at Kumamoto University of Commerce, November 1992.

- "The Federal Funds Market and Economization of Money," Japan Society

of Monetary Economics at Kyushu University, July 1992.

- The Common Session, "US financial trends," Hisashi Izu, Mitsushiro Kamino and Shoshiro Ogura, Japan Society for the Study of Credit Theory at Chuo University, October 2023.

- Dongming Wang, "The Establishment and Development of the Chinese Stock Market in a Transition Economy," Japan Society of Monetary Economics at Kyushu University, October 2023.

- Lirong Li, "Tightened FinTech regulations and its influence in China," Japan Society of Monetary Economics at Osaka University of Economics, October 2021.

- Lirong Li, "The development of credit business using artificial intelligence and its influence in China," Japan Society of Monetary Economics at Okayama Shoka University, October 2020.

- Mamoru Takahashi, "The Framework of Overseas M&A from the Enterprise Financial Viewpoint of Japan, US and German Comparison," 89th Society for the Economic Studies of Securities at Kanazawa Seiryo University, December 2018.

- Yosuke Kobayashi, "The Impact of FinTech on Retail Securities Business," 87th Society for the Economic Studies of Securities at Fukuoka University, December 2017.

- Kazuo Tamayama, "The Monetary Functiuon of Bitcoin," 85th Society for the Economic Studies of Securities at Meiji University, September 2016.

- Masashi Chikahiro, "The View of Collateralized Loan Obligations: The Present Subject and Practical Use of Money Stock," 82nd Society for the Economic Studies of Securities at

Wakayama University, November 2014.

- A Special Session, "Chinese Capital Market," Shiping Tong and Lirong Li, 81st Society for the Economic Studies of Securities at

Dokkyo University, June 2014.

- Chieko Matsuda and Yuuji Yamada, "Research on the Characteristic of Unlisted Companies: Analysis of Unlisting by MBO," 80th Society for the Economic Studies of Securities at

Sapporo Gakuin University, October 2013.

- Yasuto Dobashi, "Financial Policy during the Truman Era: Policy Operation of the Federal Reserve under the Control of the Ministry of Finance,"

Japan Society of Monetary Economics at NAGOYA University, September 2013.

- Jun-ichi Shukuwa, "The Clearing System Reform and its Importance in the European Debt Crisis: Sophisticated Clearing Systems and Clearing Risk Managements," 77th Society for the Economic Studies of Securities at Kanto Gakuin University, May 2012.

- Hisashi Izu, "The SubPrime Crisis and Private Funds," Japan Society of International Economics at KYUSHU University, December 2007

- Atsuyuki Fukaura, "Whole Business Securitisation and Indirect Financing," Japan Society of Monetary Economics at NIHON University, May 2005.

- Mitsuhiko Nakano, "Business Restructuring and Problems of Small Business Financing," 62th Society for the Economic Studies of Securities at

Momoyama Gakuin University (St. Andrew's University), November 2004.

- Board of

Governors of the Federal Reserve System

- FRB of Atlanta, Publications

- FRB of

Boston, Papers and Publications

- FRB of

Chicago, Economic Perspectives

- FRB of

Cleveland, Working Papers

- FRB of

Dallas, Working Papers

- FRB of Kansas

City, Economic Review

- FRB of

Minneapolis, Economic Research

- FRB of

New York, Research Publications

- FRB

of Philadelphia, Business Review

- FRB

of Richmond, Research Publications

- FRB of

San Francisco, Working Papers

- FRB of

St.Louis, Review

- Federal

Reserve Statistical Releases

to be continued

to be continued

as a Think tank selection report on November 6, 2021.

as a Think tank selection report on November 6, 2021.

, Research Project "The study of banking and financial businesses of big tech in China, U.S. and India."

, Research Project "The study of banking and financial businesses of big tech in China, U.S. and India."

, Research Project "The Underwriting Business of Major U.S. Financial Holding Companies in the Capital Market Oriented System" and 2016's Grant-in-Aid for Publication of Scientific Research Result, Scientific Literature JP16HP5156 "The Formation Process of U.S. OTD Model."

, Research Project "The Underwriting Business of Major U.S. Financial Holding Companies in the Capital Market Oriented System" and 2016's Grant-in-Aid for Publication of Scientific Research Result, Scientific Literature JP16HP5156 "The Formation Process of U.S. OTD Model."

supported The Changing Business of U.S. Major Financial Holding Companies: The Formation Process of OTD Model, Tokyo: NIHON KEIZAI HYORONSHA, Ltd.

supported The Changing Business of U.S. Major Financial Holding Companies: The Formation Process of OTD Model, Tokyo: NIHON KEIZAI HYORONSHA, Ltd.

Tokyo, Japan.

Tokyo, Japan.

Tokyo, Japan.

Tokyo, Japan.

Massachusetts, U.S.A.

Massachusetts, U.S.A.

a Lecturer of the

Department of Economics at the School of Oriental and African Studies, University of

London, to our University at July 11, 1996. My comment on

his lecture about Japanese financial instability.

a Lecturer of the

Department of Economics at the School of Oriental and African Studies, University of

London, to our University at July 11, 1996. My comment on

his lecture about Japanese financial instability.

"Public Credit Allocation through the Federal Reserve: Why It Is

Needed; How It Should Be Done." in Gary A.Dymski,

Gerald Epstein and Robert Pollin, eds., Transforming the U.S.

Financial System: Equity and Efficiency for the 21st

Century, New York: M.E. Sharpe 1993. = Japanese, Tokyo: NIHON

KEIZAI HYORONSHA, Ltd, 2001.

"Public Credit Allocation through the Federal Reserve: Why It Is

Needed; How It Should Be Done." in Gary A.Dymski,

Gerald Epstein and Robert Pollin, eds., Transforming the U.S.

Financial System: Equity and Efficiency for the 21st

Century, New York: M.E. Sharpe 1993. = Japanese, Tokyo: NIHON

KEIZAI HYORONSHA, Ltd, 2001.

"The 'bubble economy' and banking structure: A

Minsky Perspective on recent California, Japanese, and Korean

experience," Ehime

University, Ehime, Japan, March 27 1998.

"The 'bubble economy' and banking structure: A

Minsky Perspective on recent California, Japanese, and Korean

experience," Ehime

University, Ehime, Japan, March 27 1998.

Transforming Financial and Securities Business, Chapter 10, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2018.

Transforming Financial and Securities Business, Chapter 10, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2018.

Transformation in Capital Markets and Securities Business, Chapter 11, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2015.

Transformation in Capital Markets and Securities Business, Chapter 11, Tokyo: Public Interest Incorporated Foundation, Japan Securities Research Institute, 2015.

in Hiroshi Shibuya, ed., American-model Company and Finance: Globalization, IT and Wall Street, American Economy & Society Series No.10, Chapter 5, Kyoto: SHOWADO, 2011.

in Hiroshi Shibuya, ed., American-model Company and Finance: Globalization, IT and Wall Street, American Economy & Society Series No.10, Chapter 5, Kyoto: SHOWADO, 2011.

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.124, Special issue of US and Japan Capital Markets Workshop, December 2023.

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.124, Special issue of US and Japan Capital Markets Workshop, December 2023.

Yu-Cho Foundation, Personal Finance, Spring 2022.

Yu-Cho Foundation, Personal Finance, Spring 2022.

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.115, September 2021.

Public Interest Incorporated Foundation, Japan Securities Research Institute, The JSRI Journal of Financial and Securities Markets, No.115, September 2021.

Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.54, No.10, October 2014.

Public Interest Incorporated Foundation, Japan Securities Research Institute, Securities Review, Vol.54, No.10, October 2014.

Annals of

Society for the Economic Studies of Securities, No.43, July 2008.

Annals of

Society for the Economic Studies of Securities, No.43, July 2008.

95th Society for the Economic Studies of Securities at Nihon University, September 2023.

95th Society for the Economic Studies of Securities at Nihon University, September 2023.

Finance Plus Forum, 17th Workshop, March 2023.

Finance Plus Forum, 17th Workshop, March 2023.

US and Japan Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, December 2021.

US and Japan Capital Markets Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, December 2021.

Theme Session, "The Competition concerning FinTech and structural changes of the US financial industry," Panerist, 93th Society for the Economic Studies of Securities, September 2021.

Theme Session, "The Competition concerning FinTech and structural changes of the US financial industry," Panerist, 93th Society for the Economic Studies of Securities, September 2021.

Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, November 2019.

Security Management Workshop, Public Interest Incorporated Foundation, Japan Securities Research Institute, November 2019.

Hiroshi Shibuya (Institute of Social Science, University of Tokyo), ed., American-model Enterprise and Finance Workshop, American Economy & Society Series No.10, July 2010.

Hiroshi Shibuya (Institute of Social Science, University of Tokyo), ed., American-model Enterprise and Finance Workshop, American Economy & Society Series No.10, July 2010.

3rd

Comparative Financial System Research Workshop, U.S. Retail Finance Workshop, Financial Research and Training Center, Financial

Services Agency, Japanese Government, March 2004.

3rd

Comparative Financial System Research Workshop, U.S. Retail Finance Workshop, Financial Research and Training Center, Financial

Services Agency, Japanese Government, March 2004.

Society for the Economic Studies of Securities at Fukuoka University,

March 2023.

Society for the Economic Studies of Securities at Fukuoka University,

March 2023.